Category Archives: Trade

Gains from Exchange

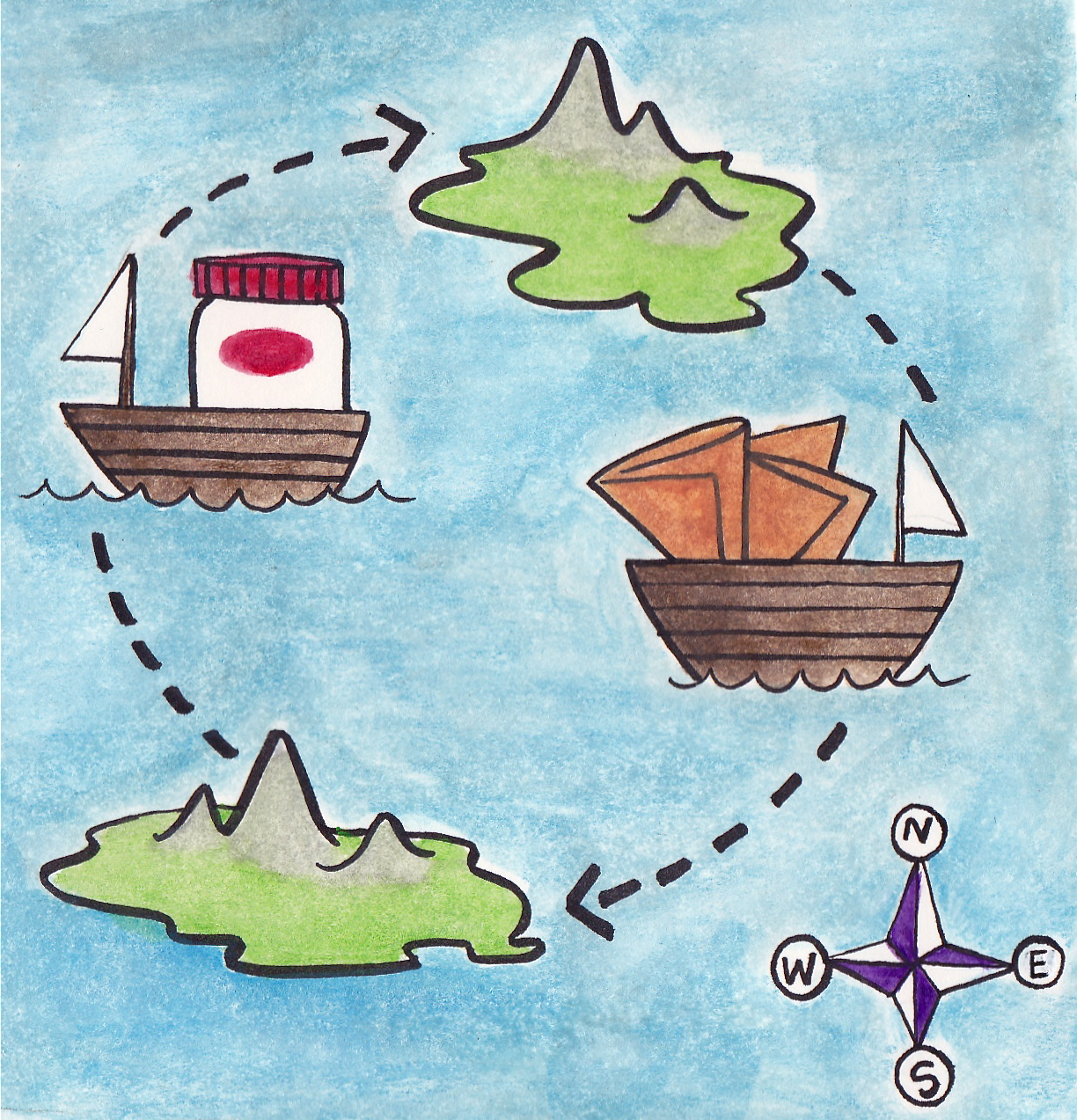

This simplified example illustrates the gains from voluntary exchange or trade:

North Island is a good place to make crepes. It is not impossible to make Nuttella ™ , but the geography makes it very difficult, so most people have to eat just crepes every day.

South Island is a good place to make Nutella. It is not impossible to make crepes, but if people in the South used all their labor and capital to produce one food, they could make much more Nutella than crepes.

The opportunity cost of making crepes is the number of jars of Nutella they could have made with those same resources.

The South has a comparative advantage in making Nutella over making crepes. Therefore, most people in the South can only eat Nutella.

Each island can increase its total output by specializing, however they would prefer to consume these two foods in a more equal proportion. They will both be better off if they trade.

its total output by specializing, however they would prefer to consume these two foods in a more equal proportion. They will both be better off if they trade.

If you are reading this on a computer, you are experiencing the gains from trade. If you did not build this computer yourself from what you could hunt or gather in nature by yourself, you traded for it.… Read More

History

Food trade is an important part of economic history. Europeans literally sailed across the world to spice up their dinners, and they stumbled across the Americas in the process. Here are some good resources to learn more:

How the Spice Trade Changed the World

Lecture Slides from Oregon State

Adam Smith, who is considered one of the founders of economic thought, argued against the European “mercantilism” ideology. Mercantilists believed that a country should export more than it imports because that would bring in gold. Smith criticized government polices that were restricting trade in order to maintain a “favorable balance of trade.” He advocated for free trade laws allowing countries to export the goods they have an advantage in making and import what is relatively more expensive for them to make.

David Ricardo formulated the theory of comparative advantage 200 years ago. In my little example, that is the idea that one island can produce Nutella more efficiently than the other island, so they have a relative advantage.

Around the same time, Thomas Malthus gave his gloomy prediction that, as the human population grows, we will run out of land to grow noms, and then people will starve (if they are not killed by war or disease first).

The human population has since increased far beyond Malthus’s wildest dreams. We are able to do that because:

1. The earth does not grow along with the economy and population. Since there is only so much land to grow food on, we increase our output through new technology that allows us to get more noms out of our limited resources.

2. Increased specialization and exchange. Ex. People in Kansas can get oranges from Florida in exchange for wheat.

International food trade policy remains an important topic of debate today.… Read More

Investing

When making cookies, it’s difficult to not eat all the cookie dough before cooking it. However, if you exert will power, preheat the oven, and exercise patience, you will get perfect warm cookies that are worth the wait.

For both individuals and societies, waiting is an important part of becoming wealthy. If you can afford to wait and make smart investments, you can trade consuming something today for consuming even more in the future.

You can invest money in a new business so that they have the start-up capital they need to become a profitable company. They will pay the amount of the loan back with interest because it cost you something to not spend the money right away.

Another way to invest is to buy something and then sell it for a higher price. Typically we don’t do this with noms because they depreciate quickly (a.k.a. get nasty in the back of the fridge)… but it happens all the time in the stock market.

Another method of investment is to buy commodities, such as gold or oil. The value of gold goes up and down, but less suddenly than most stocks. Savy gold investors are able to use sites such as BullionVault to monitor the value of their investment, and to trade online. Buy low. Sell high. … Read More